FHA construction loans are a standout option for financing your dream home. They shine with a 3.5% down payment for eligible borrowers, government-backed security, and flexible credit requirements—making them a top choice for many first-time builders. However, their strict inspection processes and lifelong mortgage insurance costs can be drawbacks. If you’re considering building or renovating, you might ask: Are FHA construction loans trustworthy? Let’s cut through the noise—what makes them work, where they excel, and what red flags to avoid—in this clear, no-nonsense guide.

What is an FHA construction loan?

An FHA construction loan is a special type of FHA-backed loan used to build a new home. It provides short-term financing, similar to a conventional construction loan, to help cover architect fees, building materials, labor costs, and other related expenses until the certificate of occupancy is obtained. Typically, borrowers convert this loan into a long-term FHA mortgage loan after the home is completed.

The main difference between FHA construction loans and conventional construction loans is that FHA loans are insured by the Federal Housing Administration (FHA). This means that the eligibility requirements for borrowers are relatively easy. For example, if you have a credit score of at least 580 and can make a down payment of 3.5% of the total loan, you will be considered eligible for this type of loan.

How does a construction loan work?

Construction loans are not like regular mortgage loans. They are usually short-term (1 year or less), and during this period the lender makes payments based on the various stages of construction. The money is released in tranches (phased disbursements) directly to your contractor or construction company. The lender appoints an independent inspector to verify the progress of the project, who approves the release of funds after each stage of work is completed. Once construction is complete, the borrower has two options: either convert it into a regular long-term mortgage loan, or take out a separate mortgage loan to pay off the construction loan.

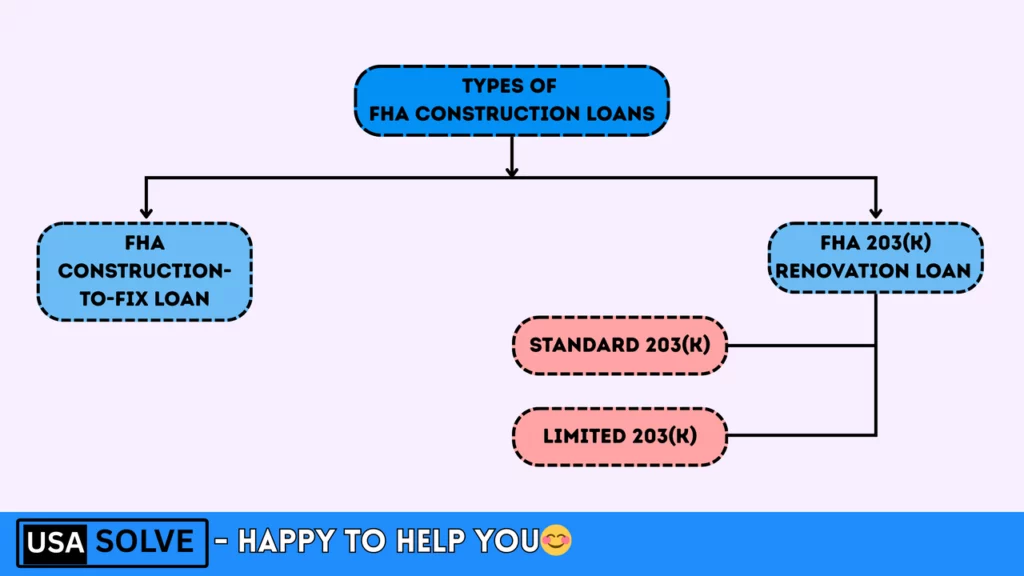

Types of FHA Construction Loans

- FHA Construction-to-Fix Loan – This loan finances the entire process of building a new home, including the cost of purchasing the land or lot. It automatically converts to a regular FHA mortgage loan after construction is complete. This loan is also known as a “single-closing loan” because it only requires a one-time closing cost—no separate fees for two separate loans.

- FHA 203(k) Renovation Loan – This loan covers the cost of buying an existing home as well as renovating or repairing it. It has two parts

- Standard 203(k) – For major renovations (minimum cost of $75,000 or more for projects with an FHA case number after November 4, 2024).

- Limited 203(k) – For small, low-budget renovation projects (maximum cost of $35,000). In both cases, you can buy and renovate the home with just one loan, rather than taking out separate loans.

FHA Construction Loan Requirements

In addition to the standard FHA loan rules, there are specific additional requirements for FHA construction loans. These are detailed below –

General Eligibility Requirements

- Credit Score – Borrowers with a credit score of 580 and above are eligible for a minimum down payment of 3.5%, while those with scores between 500 and 579 must provide a minimum down payment of 10%.

- Debt-to-Income Ratio (DTI) – Loan payments should not exceed 43% of the borrower’s monthly income (exceptions may apply).

- Down Payment – Borrowers with credit scores of 580 and above are required to make a 3.5% down payment, whereas those with scores between 500 and 579 must put down 10%.

- Loan Limit – The loan amount cannot exceed the FHA‑mandated limit. For 203(k) loans, the amount is calculated as the lesser of the home’s projected after‑renovation value and the total renovation costs. You can verify the specific limits in your area using the FHA loan limit lookup tool.

- Mortgage Insurance – Mortgage insurance consists of an Upfront Mortgage Insurance Premium (UFMIP)—a one‑time fee due at loan approval—and an Annual Mortgage Insurance Premium (MIP), which requires ongoing payments for the duration of the loan.

- Primary Residence Requirement – The loan is available exclusively for properties that the borrower will occupy as their primary residence.

Additional Construction-Related Requirements

- Project Documentation – You must provide detailed plans, a construction budget, and documentation of your contractor’s license and experience.

- For 203(k) Loans – For 203(k) loans, the Standard 203(k) program requires an FHA‑approved consultant to review and approve renovation plans and costs. Under the Limited 203(k) program, effective November 4, 2024, the maximum eligible renovation cost has increased to $75,000 (up from $35,000).

- Inspections – An FHA-approved inspector will assess progress after each phase of the construction or renovation and approve fund disbursements.

Loan Process Overview

- Construction-to-Permanent Loan – Converts automatically into a traditional FHA mortgage after construction is completed.

- 203(k) Renovation Loan – Bundles the purchase and renovation of a home into one loan.

Advantages

- Low Down Payment – FHA loans offer more flexible terms compared to conventional construction loans.

- Single Loan – No need for separate construction and permanent financing.

How to get an FHA construction loan?

To get an FHA construction loan, you need an FHA-approved lender. Not all of them offer this loan. You can find a list of lenders on the U.S. Department of Housing and Urban Development’s website. You can also look for 203(k) lenders if that’s what you need.

1. Credit and Financial Preparation

Before applying for a construction loan, start by checking your credit score and assessing your overall financial health, as these factors heavily influence loan eligibility and terms. It’s important to note that construction loans typically come with higher interest rates compared to traditional home loans, making financial preparedness critical. If your credit score is lower or your down payment savings are limited, exploring FHA loans—a government-backed option with more flexible credit requirements and smaller down payments—could be a viable alternative. However, keep in mind that a stronger credit profile and a larger down payment can help secure lower interest rates and reduce mortgage insurance costs, saving you money long-term. Additionally, always budget for unexpected expenses by setting aside extra funds to cover surprises or cost overruns during the building or renovation process, ensuring you’re financially cushioned against delays or unforeseen challenges.

2. Coordinate with Contractors and Real Estate Agents

When pursuing a construction or renovation project, collaborating closely with experienced contractors is essential. They will help you outline the scope of the work, create a realistic timeline, and provide a detailed cost estimate—critical components for your loan application and financial planning. If you’re considering an FHA 203(k) loan, which combines financing for purchase and renovation, working with an FHA-approved consultant is mandatory. This consultant plays a pivotal role in assessing renovation costs, ensuring compliance with FHA standards, and overseeing the project’s progress to keep it on track. Additionally, enlisting a knowledgeable real estate agent can streamline the process of finding suitable land, vacant lots, or existing homes that align with your vision and meet specific loan program criteria. Their expertise in identifying properties eligible for renovation under loan guidelines can save time and ensure your project starts on solid footing.

3. Construction or Renovation Loan Preapproval

To secure your construction loan, start by ensuring you meet both lender and FHA requirements, which often include a minimum credit score and other criteria outlined by your lender. The loan amount you qualify for will depend on the projected post-construction or renovation value of the property, not its current condition. Once preapproved, the construction process can begin, with your lender releasing funds incrementally as specific project milestones—like completing the foundation or framing—are met and verified through inspections. This phased payment system ensures the work stays on track and aligns with the agreed-upon budget.

To keep your construction or renovation on track, submit all required paperwork at every step. This includes contractor agreements, detailed cost lists, and updates on progress. Lenders need these to confirm the project matches the approved plans and budget. Stay focused on your budget by avoiding extra costs or changes to the original plan. Surprise expenses or delays can hurt your finances and disrupt timelines, which might affect loan payments linked to completed project stages. By keeping records tidy and spending in check, you’ll build trust with your lender, lower risks, and ensure your project finishes on time and within budget.

Alternatives to an FHA construction loan

FHA construction loans are a special type of loan that is primarily provided for the purpose of building a new home or renovating an existing home. This loan allows you to build, repair, or modernize a home for your personal residential needs. However, it is conditional—for example, the loan cannot be used to buy, sell, or build a vacation home for investment purposes. In addition, the terms of this loan require the borrower to pay a mortgage insurance premium, which can increase the overall cost of the loan. However, there are other options available in the market in addition to this type of loan, which can be considered in line with your financial plans and needs.

- Conventional Construction Loans – Conventional construction loans offer both permanent construction and construction-only options compared to FHA construction loans. However, there are two disadvantages. First, you will have to make a higher down payment than with an FHA-backed loan. Second, the minimum credit score for financing a non-FHA-backed construction loan is usually higher. However, unlike most borrowers with an FHA loan, you will not be required to pay mortgage insurance for the entire term of the loan.

- Renovation Loan – Instead of a 203(k) loan, you can take out a Homestyle Renovation Loan. This loan provides up to 75 percent of the value of your home after renovations.

- VA or USDA Construction Loan – If you are a service member, veteran, or low-income individual and want to build a home in a rural area, you can get a VA or USDA loan. These loans do not require a down payment or mortgage insurance. Credit score requirements can also be flexible. However, VA loans require a one-time fee. USDA loans require a guarantee fee.

- Home Equity Options – If you want to improve your home or other property, the equity in your current home can be a viable solution. You can use this equity to finance home renovations, property expansions, or other development projects. There are two main options available depending on your needs and goals: First, you can take out a home equity loan, commonly known as a “second mortgage.” This is a one-time payment method. Or, you can choose a home equity line of credit (HELOC), which acts as a flexible line of credit and allows you to withdraw money as needed. Both options set interest rates and terms based on the equity in your property.

- Refinancing and Cashing Out – If the interest rate on your mortgage loan decreases compared to the previous one, you can take out a new, larger loan through refinancing. In this method, the old loan is replaced with a new loan, which is available at a lower interest rate. At the same time, there is an opportunity to withdraw a portion of the equity accumulated in the home as cash. This is especially beneficial when the market interest rates have dropped significantly or you are planning a major renovation or investment. You can use this cash for home repairs, education expenses, or any emergency. A combination of refinancing and cash withdrawal can increase your financial capacity and also reduce your monthly payments.

Frequently Asked Question

What is an FHA Construction Loan?

An FHA Construction Loan is a government-backed mortgage that finances building a new home or renovating an existing one. It combines short-term construction funding with a long-term FHA mortgage, requiring only one closing. Ideal for borrowers with lower credit scores (500+), it allows a 3.5% down payment (with a 580+ credit score) and requires the home to be your primary residence.

How Does an FHA Construction Loan Work?

Unlike traditional mortgages, an FHA Construction Loan releases funds in stages (e.g., foundation, framing) after FHA-approved inspections. Once construction ends, it automatically converts to a permanent FHA mortgage. This “single-close” process saves time and closing costs.

What Are the Types of FHA Construction Loans?

The FHA Construction-to-Permanent Loan is designed to cover both the purchase of land and the costs of building a home, eventually converting into a traditional mortgage once construction is complete. Another option is the FHA 203(k) Loan, which is intended for home renovations. There are two types of 203(k) loans: the Standard 203(k), which is used for major renovations exceeding $75,000 (effective after November 2024), and the Limited 203(k), which is suitable for smaller projects with costs up to $35,000.

What Credit Score Do I Need for an FHA Construction Loan?

You need a minimum 580 credit score for a 3.5% down payment. Scores between 500–579 require 10% down. Debt-to-income (DTI) ratios must stay below 43%, with exceptions for strong compensating factors.

Can I Use an FHA Construction Loan to Buy Land?

Yes! The FHA Construction-to-Permanent Loan lets you finance both land purchase and construction costs in one loan.

What Are the FHA Construction Loan Requirements?

FHA loans are available only for primary residences, meaning they cannot be used for rental properties or vacation homes. To qualify for an FHA construction or renovation loan, borrowers must provide detailed construction plans and work with a licensed contractor. Mortgage insurance is required, which includes a 1.75% upfront fee and annual premiums ranging from 0.45% to 1.05% of the loan amount. Additionally, loan limits are determined based on the FHA guidelines specific to the borrower’s area.

How Do I Apply for an FHA Construction Loan?

To begin the process, you need to find an FHA-approved lender, preferably one that specializes in construction loans. Once you’ve selected a lender, you’ll be required to submit key financial documents, including your credit report, proof of income, and contractor bids for the construction project. Throughout the building process, inspections will be conducted at various stages, and funds will be disbursed in phases based on the progress of construction.

What Are the Pros and Cons of FHA Construction Loans?

FHA loans offer several advantages, including a low down payment requirement of just 3.5% and more flexible credit qualifications, making them accessible to a wider range of borrowers. Additionally, for construction loans, FHA provides the convenience of a single closing that covers both the construction phase and the permanent mortgage. However, there are also some drawbacks. FHA loans require mandatory mortgage insurance for the entire duration of the loan, which can increase long-term costs. Moreover, they come with strict appraisal and inspection guidelines that can complicate the homebuying process.

What Are Alternatives to an FHA Construction Loan?

Conventional construction loans typically come with higher credit requirements but offer the advantage of not requiring lifelong mortgage insurance. VA and USDA construction loans are available to eligible veterans and rural homebuyers, often with the benefit of no down payment. Additionally, homeowners can consider home equity loans, which allow them to use the equity in their current home to finance renovation projects.

Is an FHA Construction Loan Right for Me?

An FHA Construction Loan is an excellent option for individuals who have a credit score of 580 or higher and are looking to build or renovate a primary residence. This type of loan is particularly appealing to those who need a low down payment and prefer more flexible lending terms, making it a suitable choice for many first-time homebuyers and those with limited financial resources.

Conclusion

An FHA construction loan is a government-backed financing solution designed to help borrowers build or renovate a primary residence with more flexible eligibility criteria than conventional options. Key benefits include a low down payment (as low as 3.5% with a 580+ credit score), single-loan convenience (combining construction and permanent financing), and accessibility for those with moderate credit. However, it mandates mortgage insurance premiums, strict primary-residence rules, and detailed project oversight, including inspections and contractor documentation.

Who Should Consider It

- First-time homebuyers or those with limited savings for a large down payment.

- Borrowers with credit scores between 580–669 seeking manageable qualification requirements.

- Individuals aiming to build a new home or renovate an existing property (via the 203(k) program) as their primary residence.

Who Should Look Elsewhere

- Investors or those purchasing vacation/second homes, as FHA loans exclude non-owner-occupied properties.

- Borrowers with strong credit (670+) or larger down payments, who may secure better terms via conventional loans.

- Those needing high-cost renovations exceeding FHA limits or desiring no mortgage insurance.

In summary, FHA construction loans are ideal for primary residence projects with moderate budgets and credit, offering a lifeline for those excluded from conventional financing. Always weigh costs, requirements, and alternatives to align with your financial goals.

Leave a Comment